Defending Social Security

Donald Trump and Elon Musk are coming for social security.

Main Headline: Social Security is the most successful government program, keeping millions of seniors from poverty.

Social Security is one of America's most successful and beloved programs, keeping millions of seniors out of poverty. Yet, despite its popularity and proven effectiveness, it's under relentless attack from the Trump administration.

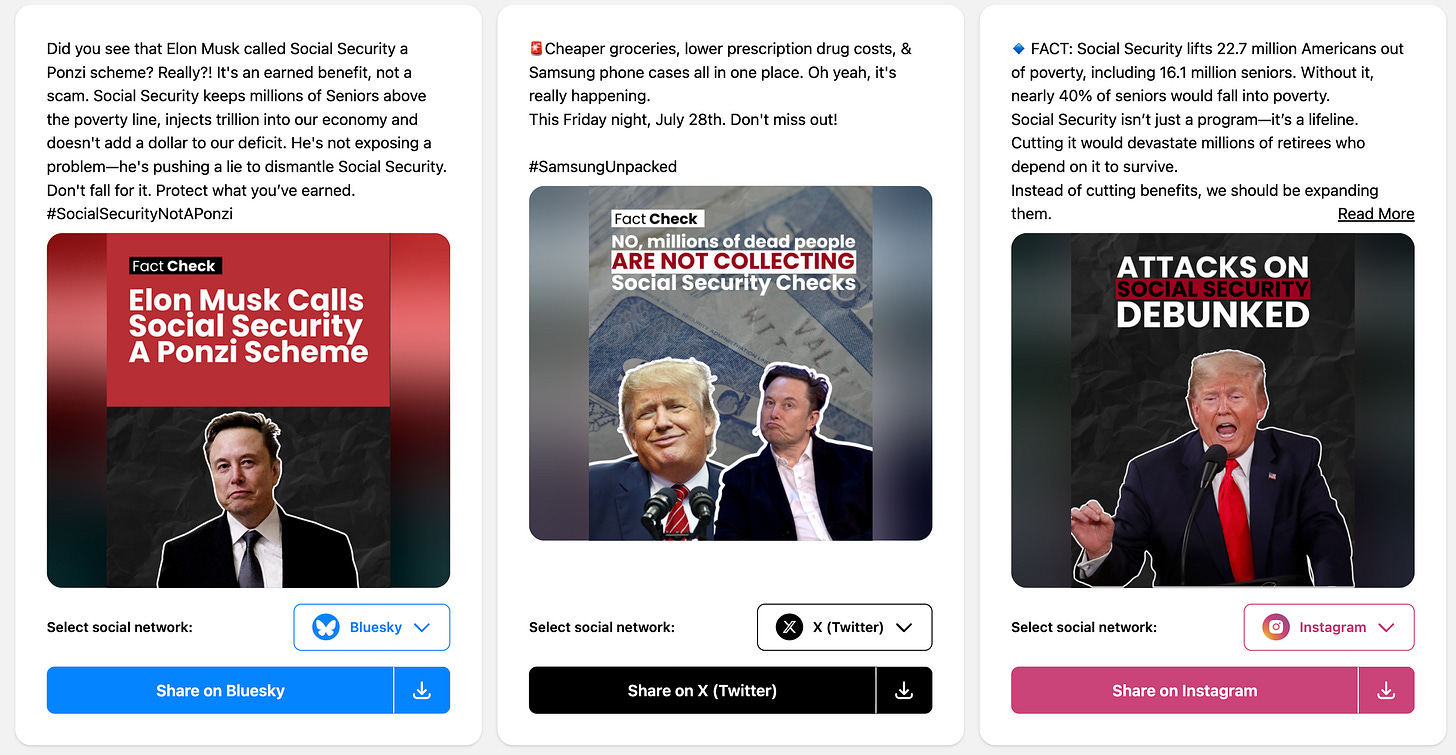

Donald Trump and Elon Musk repeatedly spread misinformation about Social Security:

Trump and Musk absurdly claim that Social Security pays benefits to people over 150 years old.

Elon Musk has called Social Security “the biggest Ponzi scheme of all time.”

Republicans have falsely claimed for decades that Social Security is "going bankrupt."

All of these lies have one aim. Eliminate Social Security.

Make no mistake about it, Donald Trump and Elon Musk are coming for Social Security. While the idea might seem politically impossible, it’s not unprecedented. Three out of the past four Republican Presidents have attacked Social Security:

Ronald Reagan raised the retirement age in 1983.

George W. Bush tried to privatize Social Security in 2005.

Donald Trump temporarily paused the payroll tax in his first term.

We can’t afford to assume Social Security’s popularity alone will protect it. The fight starts now, and we can do it by confronting these lies head-on. Here’s how.

Understanding the Importance of Social Security

Refuting the lies about Social Security is critical, but we must also emphasize a key fact: Social Security is not a handout—it’s your money. You’ve paid into it your entire working life. It’s an investment in your future and the stability of the entire country, ensuring that every American has a foundation of financial security in retirement, disability, or loss of a loved one.

Key Benefits of Social Security:

Lifts 22.7 million Americans out of poverty, including 16.1 million seniors.

Provides 50% or more of total income for half of all seniors.

Supports over 4 million children, making it one of the largest anti-child-poverty programs.

Aids 9.2 million disabled workers and their dependents through Social Security Disability Insurance.

Reduces reliance on food assistance, housing subsidies, and other safety net programs, saving taxpayers money.

Injects $1.2 trillion into the U.S. economy annually.

If Social Security is eliminated or drastically cut, nearly 40% of all seniors would fall into poverty. Many would be forced into unsafe jobs or homelessness. The financial burden would shift to working families already struggling with rising costs.

Social Security isn’t just a program—it’s an investment you’ve made. The return on your contributions protects millions from economic hardship, strengthens the economy, and guarantees dignity in retirement.

Lie #1: Social Security is filled with fraud.

Donald Trump and Elon Musk want you to believe that Social Security fraud is rampant. They claim that DOGE has uncovered "millions" of Social Security numbers for people over 150 years old in the Social Security Administration’s records.

But here’s the truth: They have provided zero evidence that any of these accounts are actively receiving benefits… because they aren’t.

This is not a new revelation. A 2023 Inspector General report—conducted by the same IG that Donald Trump later fired—examined this exact issue and found no evidence of widespread fraud or payments to people over 150. The outdated Social Security numbers in the system exist because the SSA lacks official death records for some very old accounts—not because money is being sent to the deceased.

The Facts:

Less than 1% of Social Security payments are improper.

Most errors are overpayments, not fraud.

The government actively recoups overpayments.

No fraud is acceptable, but the fact that improper payments make up less than 1% of Social Security’s budget proves that the program is well-managed. Trump and Musk’s claims are either deliberate lies or reckless misinformation aimed at lowering your confidence in the government’s ability to administer Social Security.

Lie #2: Social Security is adding to the national debt.

One of the most persistent myths about Social Security is that it contributes to the national debt. This misconception is based on a fundamental misunderstanding of how the program is funded.

The Facts:

By law, Social Security cannot add to the national debt and is completely separate from the federal budget.

It is funded through payroll taxes (FICA), investment earnings on its trust fund reserves, and taxes on some benefits.

Social Security cannot borrow money—if the trust fund is ever depleted, benefits must be adjusted to match incoming revenue.

Eliminating or drastically cutting Social Security would not reduce the national debt. Instead, it would strip millions of Americans of their earned benefits without reducing federal debt levels.

Lie #3: Social Security is going bankrupt.

One of the most insidious lies about Social Security is that it’s going bankrupt. This myth has been pushed for decades, leading many younger Americans to assume Social Security won’t be there when they retire. This fear is deliberate—convincing future generations that Social Security is doomed makes it easier to dismantle.

Let’s be clear: Social Security’s finances are strong.

Say it out loud: “Social Security’s finances are strong!”

One more time: “Social Security’s finances are strong and will stay that way—as long as Republicans and Donald Trump don’t mess with them!”

The Facts:

Claims that Social Security is “going bankrupt” refer to projections that by 2035, the trust fund reserves may be depleted—but this does NOT mean Social Security will disappear.

Social Security is funded by payroll taxes. The trust fund acts as a backup for years when tax revenue falls short of benefits paid.

Even if the trust fund runs out, Social Security will still pay benefits—at about 78% of the current level based on ongoing payroll tax revenue.

The Real Problem—and the Simple Fix

Cutting benefits to 78% of current payments would be catastrophic for millions of seniors who rely on Social Security as their primary source of income.

The solution is straightforward: Raise the cap on taxable income.

Why Raising the Cap Works:

Social Security taxes are only paid on the first $174,000 of income.

This means someone earning $90,000 a year pays Social Security taxes on 100% of their income, while someone earning $500,000 only pays on 34% of their income.

By raising or eliminating the taxable income cap, we could fully fund Social Security’s trust and prevent any benefit cuts.

This isn’t a crisis—it’s a choice. We can protect Social Security or allow Donald Trump and Elon Musk to dismantle it.

How to talk about this:

Here’s the bottom line: Social Security prevents millions of seniors from falling into poverty, stimulates our economy, and doesn’t add a single dollar to the national debt. It’s not a handout—it’s an investment you’ve made in your future.

Any attempt to raise the retirement age or cut benefits is theft. That’s your money. You paid into Social Security with every paycheck.

Trump, Musk, and the Republican Party are lying about Social Security. There is no widespread fraud, it doesn’t add to the debt, and it’s not going bankrupt.

Instead of attacking Social Security, we should protect it and expand it by raising the cap on taxable income.

Click on the image to access our Social Security toolkit and help combat Trump’s lies.

Sources:

https://oig.ssa.gov/news-releases/2024-08-19-ig-reports-nearly-72-billion-improperly-paid-recommended-improvements-go-unimplemented/

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://oig.ssa.gov/assets/uploads/a-06-21-51022.pdf

https://www.wired.com/story/elon-musk-doge-social-security-150-year-old-benefits/

https://apnews.com/article/social-security-doge-musk-trump-improper-payments-57f9e374e77e7a24fdff3afa294aa7fe

https://en.wikipedia.org/wiki/Social_Security_debate_in_the_United_States#cite_note-3

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

https://www.ssa.gov/history/hfaq.html

https://www.sfchronicle.com/opinion/openforum/article/social-security-trump-20013538.php

https://www.businessinsider.com/social-security-elon-musk-doge-fraud-trump-retirement-dead-americans-2025-2

https://web.archive.org/web/20210227111907/https://www.ssa.gov/legislation/2021FactSheet.pdf

https://www.cbo.gov/topics/social-security

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

https://oig.ssa.gov/audit-reports/

Thank you for this treasure trove of information. It's a shame that President Musk, VP Trump or any Republican doesn't even have a cursory understanding of the Social Security program.

Social Security doesn’t just help orphans, the disabled and the elderly stay out of the depths of desperate poverty.

Social Security, and safety net programs more generally, make our entire economy more stable and predictable by helping us AVOID A DEPRESSION.

That means investors have greater confidence and our markets rise. Companies invest in America because they don’t worry that we’ll become “shithole country” on short notice. They also know that people living at a subsistence level spend all of that money so, it circulates. It’s not hoarded. It creates jobs. It doesn’t trickle DOWN. It ripples ALL AROUND.

If you think capitalism and libertarianism are synonyms, think again.